This story below appeared in the Chicago Sun-Times. Hat tip to the folks at The Family Taxpayers Foundation.

Just an FYI. Teachers and administrators can collect their full pensions and work part-time. They can also work full time in other states and collect their pension from Illinois. Every time you vote yes for a referendum you condone this avaricious behavior on the part of your legislators, school employees and government employees.

State lawmakers' pension jackpot

April 6, 2003

BY TIM NOVAK STAFF REPORTER

Advertisement

Art Berman hit the pension jackpot.

The retired state senator's pension is $164,612 a year, almost three times higher than his final salary with the state.

Berman finagled state laws to land a pension that is larger than the pension of any other retired elected official in Illinois, including the past three governors.

His pension is, in fact, $14,000 higher than Gov. Blagojevich's salary.

Berman, who retired in 2001, is among the latest former legislators to jack up their pensions by basing it on a much higher salary from another government job. It's a loophole available only to about 200 current and past legislators elected before 1995, including Blagojevich and Mayor Daley.

But that's just one of several pension sweeteners legislators have given themselves over the years, allowing them to live large in retirement while so many others must scrimp to get by. Most government workers don't get anything close to such generous pensions. Nor do most of the people who must pay for them--the taxpayers.

Berman's pension is based on his $140,416 salary with the Chicago Board of Education, a job he got the day after he left the Senate and held for just 20 months. But rather than collecting a pension based on just 85 percent of that school salary, as provided by state law, Berman got an extra 33 percent boost because he worked in the Legislature longer than necessary to get a top pension. That gave him a $164,612 pension--more than his actual salary.

On top of that, Berman's pension automatically rises 3 percent each year to keep up with inflation.

And, on top of that, he never really retired anyway. Immediately after quitting his schools job--so he could start collecting his big pension--he went right back to work for the schools under an outside consulting contract that pays him $80,000 a year.

"I think that the bottom line is that I worked very, very hard for 31 years in the Legislature,'' said Berman, 67, a Chicago Democrat. "What I receive in pension is what the law provides for me.''

Berman paid $109,292 into the state pension plan in his 31 years in the Senate, but even allowing for the interest earned on that money, he's already recouped it all. From here on out, the state's financially strapped retirement system and tax-payers will finance his retirement.

"These public pensions are much more generous than most people experience,'' said Lawrence Msall, president of the Civic Federation, which monitors government spending. "There needs to be discipline attached to the benefits, such as tying increases to the rate of inflation, rather than an arbitrary level, and setting a maximum level of benefits.''

Generous government pensions--all guaranteed by taxpayers--abound across Chicago, Cook County and Illinois, according to a Chicago Sun-Times analysis of 15 retirement plans with more than 200,000 retirees. If they live long enough, most beneficiaries will receive pensions that exceed their final salaries because of the automatic 3 percent raises every year.

All but two of the 15 retirement plans are set up in such a way that employees can merge their service from various government agencies, such as the city of Chicago, Cook County, the state of Illinois, and any school district. They can move their service into the most generous plan in which they worked so they can collect the highest pension possible. For example, teachers elected to the Legislature can transfer their teacher pension credits into the legislative plan, the most lucrative. All of these government retirement plans let employees begin collecting a pension as early as age 55, sometimes at age 50 with reduced benefits.

While Berman's pension is tops among elected officials, he trails many other government workers, particularly University of Illinois faculty, one of whom has a $305,007 pension, the state's largest. A retired U. of I. athletic coach gets more than $176,000. But, unlike Berman, these government workers don't get pensions that are larger than their final state salaries.

Such generous deals--unheard of in the private sector, where most workers save for retirement through 401(k)s--have left government pension officials wondering whether they can make ends meet. The huge payouts strain many retirement funds that are woefully undercapitalized. Their investments, particularly in stocks, have plunged in value and many governments--especially the state--have failed to contribute their share of pension costs.

Among the 15 funds, the legislators retirement fund is the worst funded, with just 29 percent of the money needed to pay these pensions. And, adding to the problem, it's difficult for pension fund managers to know how much money the fund should have because legislators constantly find ways to jack up their pensions, just before they retire, far above their salaries.

"Government is the last bastion of rich pensions,'' said Mike Johnston, a pension expert for Hewitt Associates, a human resource consultant in north suburban Lincolnshire. "Private companies have reviewed their pension plans. They've cut their pension plans. They've put in 401(k)s. But government has done nothing.''

Government workers justify their higher pensions by pointing out that, for the most part, they are barred from participating in the Social Security system.

Dozens of government workers have significantly boosted their incomes by collecting a pension from one agency while working for another. Among them are former Chicago Police Supt. LeRoy Martin, Cook County Judge Nancy Drew Sheehan, state Sen. Lou Viverito and Secretary of State Jesse White. The Sun-Times will report that part of the story in Monday's paper.

And hundreds of retirees get at least two government pensions. These include former Cook County Judge John Beatty, former Cook County Board President George Dunne, former state Sen. Beverly Fawell and former state Rep. William Laurino.

*****

Legislators aren't the only public officials taking advantage of lucrative pension loopholes. Like Berman, several DuPage and Will county elected officials are receiving pensions based on their last day's pay. That loophole is open to scores of elected county officials who held office between 1994 and 2001.

Berman said he was surprised to hear his pension is tops for all legislators. But he doesn't think his former constituents will object. "I think they'll be surprised," he said. "But would they turn the clock back 31 years and not have Art Berman serve at all? I don't think so.''

Almost half of the 249 retired lawmakers now collecting pensions receive checks that exceed their final salary as a legislator, state records show. Illinois legislators, who set all government pension laws in the state, have given themselves the best benefits.

Legislators with 20 years of government service can get a pension equal to 85 percent of their final day's pay, which can come from virtually any job in a city, county or state agency. After several used the loophole to strike it rich, the Legislature closed the loophole for those elected after 1995.

Under another loophole that one lawmaker wants to plug, legislators who serve more than 20 years--the total needed for a top pension--get a 3 percent boost in their pension for each extra year of service. The only catch is that they must be retired for a year to get that bump. Thanks to that rule, former Gov. George Ryan's pension will soar 39 percent next year.

Berman used both loopholes.

When Berman left the state Senate on Jan. 2, 2000, his salary was $59,657. That entitled him to a pension of $50,708, which would have jumped to $67,442 a year later because he had 11 extra years of service. But he rejected that option.

Instead, Berman went to work the very next day as the Chicago Board of Education's director of labor mediation services, hired by an old friend, Chicago Public Schools Supt. Paul Vallas. Berman retired from that post on Aug. 31, 2001, at which point his state pension could now be based on his $140,516 salary from the schools.

That gave Berman an initial pension of $119,440, which soared to $164,612 last year when his extra years of service in the Legislature were taken into account.

But all the while, Berman never stopped working as the school's director of labor mediation services. He went from a regular employee earning $140,516 to a contractual worker earning $80,000 annually.

"I have to keep 26 labor unions happy and the Board of Education happy,'' Berman said. "That's only part of my

responsibilities here. I sit in on legislative agenda meetings. I serve on three statewide commissions dealing with education policy and funding, and I'm constantly in touch with my fellow legislators and policymakers. "I fight for education and children,'' he said.

"I would have made a lot more money by not going to work for the Board of Education, going back to my law firm, and just drawing my pension based on my legislative salary.''

Saturday, June 03, 2006

Friday, June 02, 2006

Two pensions and a county job at 91

This story below appeared in the Chicago Sun-Times. Hat tip to the folks at The Family Taxpayers Foundation.

Just an FYI. Teachers and administrators can collect their full pensions and work part-time. They can also work full time in other states and collect their pension from Illinois. Every time you vote yes for a referendum you condone this avaricious behavior on the part of your legislators, school employees and government employees.

Two pensions and a county job at 91

BY TIM NOVAK STAFF REPORTER

Erwin "Red'' Weiner may be the oldest double dipper in Illinois.

At 91, Weiner has two government pensions and a job with the Cook County Forest Preserve District, which would give him an annual income of $188,873.

But Weiner has been on disability leave for the past 18 months so he's only been getting half of his $73,263 salary along with pension checks worth $115,610. His disability payments run out in May.

Weiner could not be reached for comment. He is a close friend of Cook County Board President John Stroger, who runs the forest preserve district.

Weiner is a maintenance superintendent for the forest preserve. He gets an $84,233 pension as a retired county employee, and a $31,377 pension from the Chicago Park District.

After 40 years at the parks, Weiner retired in 1969 as general superintendent, the top job. He began collecting a pension in 1970 when he landed a county job. He was the county's human resources chief when he retired again in 1993. He started at the forest preserve in January 1995.

Just an FYI. Teachers and administrators can collect their full pensions and work part-time. They can also work full time in other states and collect their pension from Illinois. Every time you vote yes for a referendum you condone this avaricious behavior on the part of your legislators, school employees and government employees.

Two pensions and a county job at 91

BY TIM NOVAK STAFF REPORTER

Erwin "Red'' Weiner may be the oldest double dipper in Illinois.

At 91, Weiner has two government pensions and a job with the Cook County Forest Preserve District, which would give him an annual income of $188,873.

But Weiner has been on disability leave for the past 18 months so he's only been getting half of his $73,263 salary along with pension checks worth $115,610. His disability payments run out in May.

Weiner could not be reached for comment. He is a close friend of Cook County Board President John Stroger, who runs the forest preserve district.

Weiner is a maintenance superintendent for the forest preserve. He gets an $84,233 pension as a retired county employee, and a $31,377 pension from the Chicago Park District.

After 40 years at the parks, Weiner retired in 1969 as general superintendent, the top job. He began collecting a pension in 1970 when he landed a county job. He was the county's human resources chief when he retired again in 1993. He started at the forest preserve in January 1995.

Thursday, June 01, 2006

John Dewey’s Theories of Education on Marxists Archive - Notable AFT Figure.

By W. F. Warde (George Novack)

John Dewey’s Theories of Education

Written: 1960

Source: International Socialist Review, Vol. 21, No. 1, Winter 1960.

Transcription/Editing: 2005 by Daniel Gaido

HTML Markup: 2005 by David Walters

Public Domain:George Novak Internet Archive 2005; This work is completely free. In any reproduction, we ask that you cite this Internet address and the publishing information above.

October 20, 1959 marked the one-hundredth anniversary of John Dewey’s birthday. This eminent thinker of the Progressive movement was the dominant figure in American education. His most valuable and enduring contribution to our culture came from the ideas and methods he fathered in this field.

Dewey won a greater international following for his educational reforms than for his instrumentalist philosophy. Between the two World Wars, where previously backward countries were obliged to catch up quickly with the most modern methods, as in Turkey, Japan, China, the Soviet Union and Latin America, the reshapers of the educational system turned toward Dewey’s innovations for guidance.

Most broadly considered, Dewey’s work consummated the trends in education below the university level initiated by pioneer pedagogues animated by the impulses of the bourgeois-democratic revolution. This was especially clear in his views on child education which built on ideas first brought forward by Rousseau, Pestalozzi and Froebel in Western Europe and by kindred reformers in the United States.

In its course of development on a world scale the democratic movement forced consideration of the needs and claims of one section of the oppressed after another. Out of the general cause of “rights of the people” there sprouted specific demands voicing the grievances of peasants, wage workers, the religiously persecuted, slaves, women, paupers, the aged, the disabled, prisoners, the insane, the racially oppressed.

The movement to reform child education must be viewed in this historical context. Children as such are not usually included among the oppressed. Yet they necessarily compose one of the weakest, most dependent and defenseless sections of the population. Each generation of children is not only helped but hindered and hurt by the elders who exercise direct control over them.

To view the rest of the story go to Marxists Internet Archive.

The American Federation of Teachers has always counted John Dewey as one of its notable figures.

John Dewey’s Theories of Education

Written: 1960

Source: International Socialist Review, Vol. 21, No. 1, Winter 1960.

Transcription/Editing: 2005 by Daniel Gaido

HTML Markup: 2005 by David Walters

Public Domain:George Novak Internet Archive 2005; This work is completely free. In any reproduction, we ask that you cite this Internet address and the publishing information above.

October 20, 1959 marked the one-hundredth anniversary of John Dewey’s birthday. This eminent thinker of the Progressive movement was the dominant figure in American education. His most valuable and enduring contribution to our culture came from the ideas and methods he fathered in this field.

Dewey won a greater international following for his educational reforms than for his instrumentalist philosophy. Between the two World Wars, where previously backward countries were obliged to catch up quickly with the most modern methods, as in Turkey, Japan, China, the Soviet Union and Latin America, the reshapers of the educational system turned toward Dewey’s innovations for guidance.

Most broadly considered, Dewey’s work consummated the trends in education below the university level initiated by pioneer pedagogues animated by the impulses of the bourgeois-democratic revolution. This was especially clear in his views on child education which built on ideas first brought forward by Rousseau, Pestalozzi and Froebel in Western Europe and by kindred reformers in the United States.

In its course of development on a world scale the democratic movement forced consideration of the needs and claims of one section of the oppressed after another. Out of the general cause of “rights of the people” there sprouted specific demands voicing the grievances of peasants, wage workers, the religiously persecuted, slaves, women, paupers, the aged, the disabled, prisoners, the insane, the racially oppressed.

The movement to reform child education must be viewed in this historical context. Children as such are not usually included among the oppressed. Yet they necessarily compose one of the weakest, most dependent and defenseless sections of the population. Each generation of children is not only helped but hindered and hurt by the elders who exercise direct control over them.

To view the rest of the story go to Marxists Internet Archive.

The American Federation of Teachers has always counted John Dewey as one of its notable figures.

Wednesday, May 31, 2006

SAT scores dropped significantly this year. Blame the schools, not the test.

The following piece appeared in the Wall Street Journal.

How Low Can We Go?

SAT scores dropped significantly this year. Blame the schools, not the test.

BY DAVID S. KAHN

Friday, May 26, 2006 12:01 a.m. EDT

Colleges across the country are reporting a drop in SAT scores this year. I've been tutoring students in New York City for the SAT since 1989, and I have watched the numbers rise and fall. This year, though, the scores of my best students dropped about 50 points total in the math and verbal portions of the test (each on a scale of 200 to 800). Colleges and parents are wondering: Is there something wrong with the new test? Or are our children not being taught what they should know?

Before 1994, the verbal section of the SAT was about 65% vocabulary (55 out of 85 questions) and 35% reading comprehension. Then the Educational Testing Service shortened and reworked the test, devoting half of the 78 questions to each area. Last year ETS changed the test again, and now it is heavily skewed toward reading: 49 of the 68 items require students to read, synthesize and answer questions.

In such a way, ETS has increased the penalty for not reading throughout one's school years. Studying vocabulary lists before the test--a long-favored shortcut to lifting scores--just won't cut it anymore. Students who read widely and often throughout their elementary and high-school years develop the kinds of reading skills measured by the new SAT. Students who avoid reading don't--and can't develop them in a cram course.

The math section of the test also got more challenging. The SAT used to test algebra, geometry and arithmetic. Students weren't allowed to use calculators on the original SAT, so some of those problems were simply difficult arithmetical calculations (fractions, decimals and percentages). In 1994, calculators were allowed, and the questions got a bit easier--and I watched my students' math scores jump. But last year ETS made it harder by adding pre-calculus questions, and my students have struggled.

Now there are also fewer math questions--each of which counts for more. The 54 math questions count for 11 points each now (on the 200 to 800 scale); before, there were 60 questions that counted for 10 each. So if a student gets 20 questions wrong, he effectively loses 222 points instead of the former 200.

Quite simply, this is not the same SAT. Students, anxious parents and college admissions officers can't really equate this new test with those of previous years--or their results. We need to adjust our expectations accordingly. It used to be that a 650 was a really high score. After a batch of adjustments, 700 became a really high score. Now it's probably around 670. Or to use the new SAT scale--a scale that includes a writing sample graded for another possible 800 points--you've done pretty well if you eke out a score of 2000, out of a possible 2400.

Some colleges attribute the drop in numbers to the fact that the test is longer--the writing sample has added about an hour to the test's time. If so, then students should do worse on the last sections of the test than they do on the earlier parts. (There are 10 sections to the new SAT.) That hasn't been the case for my (admittedly small) sample of students.

The colleges also think that the lowering of average test scores may have something to do with the cost of taking the test. It is now $41.50, up from $28 in 2004, and so they suggest that fewer students are taking the test twice (which generally results in a slightly higher score). But that theory is weak. Colleges also report that potential students are sending them more applications than ever before, from an average of five per student to 10 or more. Given that college applications usually cost between $50 and $75 per school, the colleges are saying that students are paying an extra $250 and more to apply to additional colleges but won't pay to take the SAT a second time because the price of the test has gone up $13. I'm skeptical.

The explanation is much more straightforward. The average American receives a pretty mediocre education. The average SAT score drifted down from 1000 in the 1960s to 880 in 1993. Education activists attributed this plummet to cultural factors, a change in the testing pool and other matters. The blame was placed everywhere but on schools. That the quality of education in America declined from the 1960s to the 1990s was hardly noted in debates over the SAT.

And then the test was "recentered." Thanks to the change in the SAT scale and the change in the kinds of questions that were asked on the test, scores went up and people were able to ignore the fact that most students are not well-educated. Indeed, parents compared their children's scores with their own and concluded that their children were brilliant. Now ETS has made it a little harder to get away with not knowing your three R's.

People complain that the SAT is biased and that the bias explains why students don't do well. That's true--it is biased. It's biased against people who aren't well-educated. The test isn't causing people to have bad educations, it's merely reflecting the reality. And if you don't like your reflection, that doesn't mean that you should smash the mirror.

That the new SAT tests more reading comprehension than the old test did is a good thing. Colleges complain that their incoming students don't have sufficient skills to read and analyze the kind of material that their professors will assign them. I hope that the new SAT's emphasis will make students realize that you can't get much of an education if you can't read.

Maybe the decline in SAT scores will force people to notice that their children are not getting good educations. If your children don't read or do math, why would you think that they would do well on the SAT? I would love to get into a time machine and go back to 1960 and give this new SAT to high-school students back then. I suspect that they would do much better than today's students. If we want people to get good scores on the SAT, I have a suggestion. Stop complaining about how unfair the test is and do your homework.

How Low Can We Go?

SAT scores dropped significantly this year. Blame the schools, not the test.

BY DAVID S. KAHN

Friday, May 26, 2006 12:01 a.m. EDT

Colleges across the country are reporting a drop in SAT scores this year. I've been tutoring students in New York City for the SAT since 1989, and I have watched the numbers rise and fall. This year, though, the scores of my best students dropped about 50 points total in the math and verbal portions of the test (each on a scale of 200 to 800). Colleges and parents are wondering: Is there something wrong with the new test? Or are our children not being taught what they should know?

Before 1994, the verbal section of the SAT was about 65% vocabulary (55 out of 85 questions) and 35% reading comprehension. Then the Educational Testing Service shortened and reworked the test, devoting half of the 78 questions to each area. Last year ETS changed the test again, and now it is heavily skewed toward reading: 49 of the 68 items require students to read, synthesize and answer questions.

In such a way, ETS has increased the penalty for not reading throughout one's school years. Studying vocabulary lists before the test--a long-favored shortcut to lifting scores--just won't cut it anymore. Students who read widely and often throughout their elementary and high-school years develop the kinds of reading skills measured by the new SAT. Students who avoid reading don't--and can't develop them in a cram course.

The math section of the test also got more challenging. The SAT used to test algebra, geometry and arithmetic. Students weren't allowed to use calculators on the original SAT, so some of those problems were simply difficult arithmetical calculations (fractions, decimals and percentages). In 1994, calculators were allowed, and the questions got a bit easier--and I watched my students' math scores jump. But last year ETS made it harder by adding pre-calculus questions, and my students have struggled.

Now there are also fewer math questions--each of which counts for more. The 54 math questions count for 11 points each now (on the 200 to 800 scale); before, there were 60 questions that counted for 10 each. So if a student gets 20 questions wrong, he effectively loses 222 points instead of the former 200.

Quite simply, this is not the same SAT. Students, anxious parents and college admissions officers can't really equate this new test with those of previous years--or their results. We need to adjust our expectations accordingly. It used to be that a 650 was a really high score. After a batch of adjustments, 700 became a really high score. Now it's probably around 670. Or to use the new SAT scale--a scale that includes a writing sample graded for another possible 800 points--you've done pretty well if you eke out a score of 2000, out of a possible 2400.

Some colleges attribute the drop in numbers to the fact that the test is longer--the writing sample has added about an hour to the test's time. If so, then students should do worse on the last sections of the test than they do on the earlier parts. (There are 10 sections to the new SAT.) That hasn't been the case for my (admittedly small) sample of students.

The colleges also think that the lowering of average test scores may have something to do with the cost of taking the test. It is now $41.50, up from $28 in 2004, and so they suggest that fewer students are taking the test twice (which generally results in a slightly higher score). But that theory is weak. Colleges also report that potential students are sending them more applications than ever before, from an average of five per student to 10 or more. Given that college applications usually cost between $50 and $75 per school, the colleges are saying that students are paying an extra $250 and more to apply to additional colleges but won't pay to take the SAT a second time because the price of the test has gone up $13. I'm skeptical.

The explanation is much more straightforward. The average American receives a pretty mediocre education. The average SAT score drifted down from 1000 in the 1960s to 880 in 1993. Education activists attributed this plummet to cultural factors, a change in the testing pool and other matters. The blame was placed everywhere but on schools. That the quality of education in America declined from the 1960s to the 1990s was hardly noted in debates over the SAT.

And then the test was "recentered." Thanks to the change in the SAT scale and the change in the kinds of questions that were asked on the test, scores went up and people were able to ignore the fact that most students are not well-educated. Indeed, parents compared their children's scores with their own and concluded that their children were brilliant. Now ETS has made it a little harder to get away with not knowing your three R's.

People complain that the SAT is biased and that the bias explains why students don't do well. That's true--it is biased. It's biased against people who aren't well-educated. The test isn't causing people to have bad educations, it's merely reflecting the reality. And if you don't like your reflection, that doesn't mean that you should smash the mirror.

That the new SAT tests more reading comprehension than the old test did is a good thing. Colleges complain that their incoming students don't have sufficient skills to read and analyze the kind of material that their professors will assign them. I hope that the new SAT's emphasis will make students realize that you can't get much of an education if you can't read.

Maybe the decline in SAT scores will force people to notice that their children are not getting good educations. If your children don't read or do math, why would you think that they would do well on the SAT? I would love to get into a time machine and go back to 1960 and give this new SAT to high-school students back then. I suspect that they would do much better than today's students. If we want people to get good scores on the SAT, I have a suggestion. Stop complaining about how unfair the test is and do your homework.

Tuesday, May 30, 2006

Taxpayer advocacy group plans to file suit.

More Questions Arise as Suit is Being Finalized!

(Updated 05/20/06)

While compiling the list of documentation supporting our claims of questionable practices surrounding our new schools, additional facts were discovered that raise even more questions about the validity of this project. Some of the questions we hope to get answers to during the course of litigation are as follows.

1. Did the state approve enough repairs to allow our district to legally sell bonds?

2. If the contracts specified same size buildings, why are the new buildings 30-40% larger?

3. Why would the regional superintendent give these buildings passing grades on annual inspections, then sign off on destroying them based on unsupported claims of serious safety concerns?

To view the rest of the story visit the Coalition For Public Awareness website.

We have often said investigate and you will find waste, corruption, patronage and/or fraud. That is exactly what the Coalition For Public Awareness

is uncovering. This site serves as an example for others to follow.

Public schools are nothing more than government run schools. Like in the government you will find waste, fraud, corruption and patronage. The governor and legislators of Illinois our essentially beholden to the lobbyist of the public education system. This can be seen almost daily in the newspapers and the legislation that is granted in favor of the employees of these systems.

(Updated 05/20/06)

While compiling the list of documentation supporting our claims of questionable practices surrounding our new schools, additional facts were discovered that raise even more questions about the validity of this project. Some of the questions we hope to get answers to during the course of litigation are as follows.

1. Did the state approve enough repairs to allow our district to legally sell bonds?

2. If the contracts specified same size buildings, why are the new buildings 30-40% larger?

3. Why would the regional superintendent give these buildings passing grades on annual inspections, then sign off on destroying them based on unsupported claims of serious safety concerns?

To view the rest of the story visit the Coalition For Public Awareness website.

We have often said investigate and you will find waste, corruption, patronage and/or fraud. That is exactly what the Coalition For Public Awareness

is uncovering. This site serves as an example for others to follow.

Public schools are nothing more than government run schools. Like in the government you will find waste, fraud, corruption and patronage. The governor and legislators of Illinois our essentially beholden to the lobbyist of the public education system. This can be seen almost daily in the newspapers and the legislation that is granted in favor of the employees of these systems.

Monday, May 29, 2006

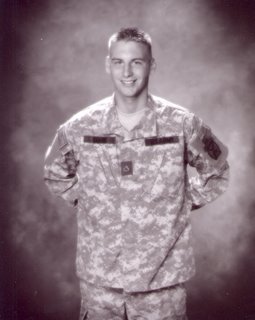

U.S. Army Spc, E-4, Eric D. Clark

Dear Friends and Readers,

We were out of town and also dealing with the loss of a good friend's son in the Iraq conflict. Memorial Day is May 29th. Please take a moment to say a prayer or if you do not pray take a moment to remember all those who have fought and died for our freedom.

We updated our Blog with posts for the following dates May 12th through May 25th.

We realize this is not an ordinary post however it is because of men like Eric D. Clark that we are a free country. Bravery of our soldiers allows us to fight for education reform and education spending reform.

United States Army Specialist E-4, Eric D. Clark, age 22, of Pleasant Prairie was killed while on active duty, serving his country at Camp Liberty, Baghdad, Iraq.

Born in Winfield, IL on July 14, 1983 and destined for great things, Eric was the first born to proud parents, Joanne Leipzig and Kevin Clark.

He attended St. Therese Elementary School, St. Joseph Jr. High School and was a 2001 graduate of Indian Trails Academy where his interest in multimedia expanded. While attending High School, Eric enjoyed working for Tinseltown, and enlisted in the U.S. Army while employed at Pizza Hut. His enlistment was a personal goal because Eric wanted to serve his country. He enrolled in an accelerated program, allowing him to achieve a higher military rank when he began his service career.

His faith was enhanced as a member of St. Anthony Catholic Church - his talent as a musician flourished as a member of the CYO Band where he played the flute and drums. But Eric’s life was really more about what he did for others that made such an impact. Considered an “Impressionist”, Eric could flawlessly assume the voice and character of actors as well as social and cultural dialects. He had a true passion for acting and aspired to one day influence the lives of children through a career as a teacher.

Aside from the selfless act of serving our country in the U.S. Army, Eric was an incredible person. He had the natural ability to lighten the mood, put a smile on your face, and add positive energy to any room. Wherever he went and whatever he did seemed to make a lasting impression on the lives of those he came in contact with. Young and old alike took to this young man full of life – touching people’s hearts and minds at every turn.

Eric’s military career spanned only a few short years, but included: Boot Camp at Fort Sill, Oklahoma, graduating in May 2003. He was then deployed to Korea, at Camp Hovey – 2-17th Artillery “Steel Battalion” Alpha Battery serving from June 2003 to July 2004. Eric achieved placement in 10th Mountain Division, Fort Drum, New York in July 2004, then was deployed to Iraq in August 2005.

He will always be remembered for unselfishly protecting the freedoms of his country, and remarkably influencing the lives of his family and friends.

Eric leaves to cherish his memory his mother and step-father, Joanne and Bob Marfechuk, of Pleasant Prairie; his father and step-mother, Kevin and Paula Clark, of Kenyon, MN; a sister, Jade Clark, a student at Northern Arizona Univ., Flagstaff, AZ; a brother Evan Clark at home; twin half-sisters Meg and Audra Clark; Maternal Grandmother, Mary Leipzig, of Kenosha; Paternal Grandparents, Dan and Yvonne Clark, of Pardeeville, WI; Maternal Step-Grandparents, Walter and Josephine Marfechuk, of Warren, MI; a step-brother Jared Buckingham; and a step-sister, Anna Buckingham.

He was preceded in death by his Maternal Grandfather, Harry Leipzig; and a brother, Eric Joseph, in infancy.

Sunday, May 28, 2006

Everyone Has Been Conned!

"Everyone has been conned - you can give public schools all the money in America and it will never be enough." Ben Chavis a former public school prinicipal now runs a Charter School.

The above quote was found in John Stossel's Myths, Lies, and Downright Stupidity Get Out the Shovel Why Everything YOu Know Is Wrong.

The above quote was found in John Stossel's Myths, Lies, and Downright Stupidity Get Out the Shovel Why Everything YOu Know Is Wrong.

Saturday, May 27, 2006

Class size, tax promises bother District 93 parents

The article below appeared on Students First and in the Daily Herald. . The first mistake the parents made was trusting the school district and voting yes for the referendum. The following quote is classic and speaks volumes as to how this and most districts pass referenda. "Superintendent Hank Gmitro said the district had merely warned of class sizes increasing if the tax increase failed." They used fear and threats to pass the referenda and the voters of District 93 fell for it.

Many school districts will be back in November to try to pass referenda. Will you vote yes based on fear and threats or will you hold the people to educate and protect our children accountable for their actions.

Parents you need to do research. Pass grade 3 class size does not matter. What does matter is the quality of the teacher and parental involvement. See our resources page for information to read about class size.

Would you rather have your child in a classroom of 20 with an average to poor teacher or classroom of 30 - 35 with a good to great teacher? Which is more efficient and economical? We would take a classroom of 30-35 any day for our daughter. The fewer the teachers in a school the more likely you will have better teachers.

Class size, tax promises bother District 93 parents

5/26/2006

By Jack Komperda

Daily Herald

Several parents of third-graders at Carol Stream's Heritage Lakes Elementary are upset because their children's class sizes will rise by at least six students come next fall.

The parents have met several times with school administrators to persuade them to lower the class sections from the current 24-student average.

Though school officials refute it, the parents say the unexpected spike is akin to a broken campaign promise Carol Stream Elementary District 93 administrators made shortly before a successful 2004 tax-hike referendum.

"One of the things they promised during the referendum was smaller class sizes," said parent Ginny Furioso. "Now we're being told the class sizes can increase. Such a sudden jump for these kids … it's an extreme shock."

Superintendent Hank Gmitro said the district had merely warned of class sizes increasing if the tax increase failed.

He said the districtwide average of 21 students per class will remain, though some classes will be larger. He pointed out it's an inexact science since the district can't control the number of students who show up.

"I'm the one who shared the referendum information (before the vote)," he said. "What I talked about was maintaining class sizes. From my perspective, we've kept our commitment."

Heritage Lakes isn't the only district school with some class sections that will surpass the average, according to district enrollment projections.

Six grade levels across the district's six elementary schools will see, on average, spikes of four or more students in classroom sections next fall.

Overall, administrators also identified nine cases at all six elementary buildings in which class sizes in an entire grade level could remain above 21 students.

"It's a moving target," Gmitro said. "Five to seven years ago, we had class sizes of 28 to 30 students. We have none of that size now."

Indeed, the largest class size projections are expected at Carol Stream Elementary, where the incoming fourth-graders will have class two sizes of about 25 and 26 students. Those students are now split into three third-grade sections averaging 17 students.

Next year's third-graders will also have larger classes. The students are projected to have one less section with classes of 22 and 23 students.

At Elsie Johnson Elementary School in Hanover Park, next year's third-grade classes will have 23 and 24 students, up more than six from the current second-grade average of 17 students.

And at Cloverdale Elementary School in Carol Stream, the incoming fifth-graders will see their class sizes jump from 20 students to about 24 per class.

That spike, though, is offset by next year's third-grade class sections, whose average class size is expected to fall from about 26 to 20 students each.

"Class sizes are always a sore point with parents," said Maria Balas, a PTA member and Cloverdale parent. "From other parents I've talked to, the ideal comfort level would be a class size of 24."

Gmitro said he expects hundreds of children will move in or out of the district by registration time in August. Some class-size averages could change depending on where those population shifts occur.

Mary Lynn Campagna, another parent of a Heritage Lakes third-grader, said she hopes more children show up in her child's grade so the district would ad a section.

"I only hope more kids move in to give us another teacher," she said. "At that point, what would they do?"

Many school districts will be back in November to try to pass referenda. Will you vote yes based on fear and threats or will you hold the people to educate and protect our children accountable for their actions.

Parents you need to do research. Pass grade 3 class size does not matter. What does matter is the quality of the teacher and parental involvement. See our resources page for information to read about class size.

Would you rather have your child in a classroom of 20 with an average to poor teacher or classroom of 30 - 35 with a good to great teacher? Which is more efficient and economical? We would take a classroom of 30-35 any day for our daughter. The fewer the teachers in a school the more likely you will have better teachers.

Class size, tax promises bother District 93 parents

5/26/2006

By Jack Komperda

Daily Herald

Several parents of third-graders at Carol Stream's Heritage Lakes Elementary are upset because their children's class sizes will rise by at least six students come next fall.

The parents have met several times with school administrators to persuade them to lower the class sections from the current 24-student average.

Though school officials refute it, the parents say the unexpected spike is akin to a broken campaign promise Carol Stream Elementary District 93 administrators made shortly before a successful 2004 tax-hike referendum.

"One of the things they promised during the referendum was smaller class sizes," said parent Ginny Furioso. "Now we're being told the class sizes can increase. Such a sudden jump for these kids … it's an extreme shock."

Superintendent Hank Gmitro said the district had merely warned of class sizes increasing if the tax increase failed.

He said the districtwide average of 21 students per class will remain, though some classes will be larger. He pointed out it's an inexact science since the district can't control the number of students who show up.

"I'm the one who shared the referendum information (before the vote)," he said. "What I talked about was maintaining class sizes. From my perspective, we've kept our commitment."

Heritage Lakes isn't the only district school with some class sections that will surpass the average, according to district enrollment projections.

Six grade levels across the district's six elementary schools will see, on average, spikes of four or more students in classroom sections next fall.

Overall, administrators also identified nine cases at all six elementary buildings in which class sizes in an entire grade level could remain above 21 students.

"It's a moving target," Gmitro said. "Five to seven years ago, we had class sizes of 28 to 30 students. We have none of that size now."

Indeed, the largest class size projections are expected at Carol Stream Elementary, where the incoming fourth-graders will have class two sizes of about 25 and 26 students. Those students are now split into three third-grade sections averaging 17 students.

Next year's third-graders will also have larger classes. The students are projected to have one less section with classes of 22 and 23 students.

At Elsie Johnson Elementary School in Hanover Park, next year's third-grade classes will have 23 and 24 students, up more than six from the current second-grade average of 17 students.

And at Cloverdale Elementary School in Carol Stream, the incoming fifth-graders will see their class sizes jump from 20 students to about 24 per class.

That spike, though, is offset by next year's third-grade class sections, whose average class size is expected to fall from about 26 to 20 students each.

"Class sizes are always a sore point with parents," said Maria Balas, a PTA member and Cloverdale parent. "From other parents I've talked to, the ideal comfort level would be a class size of 24."

Gmitro said he expects hundreds of children will move in or out of the district by registration time in August. Some class-size averages could change depending on where those population shifts occur.

Mary Lynn Campagna, another parent of a Heritage Lakes third-grader, said she hopes more children show up in her child's grade so the district would ad a section.

"I only hope more kids move in to give us another teacher," she said. "At that point, what would they do?"

Friday, May 26, 2006

Tasteless journalism

The following letter appeared in the Northwest Herald.

Tasteless journalism

To the Editor:

The Northwest Herald's May 19 editorial about electioneering in District 300 truly sets a new low for tasteless journalism. A more appropriate title might have been "Why we love taxes and hate Jack Roeser."

No matter what one thinks of Roeser, the Northwest Herald's assertion that his inquiries are sour grapes is totally baseless. Pass or fail, the District 300 referendum had more than enough "unusual" activity to justify raising questions. When did Roeser ever claim referendums couldn't pass without election interference?

By the Northwest Herald's logic, O.J. Simpson's prosecutors were petty, vindictive types who couldn't accept defeat simply because O.J. was acquitted.

How can a newspaper fail to value a citizen's right to ask questions?

Watergate anyone?

Without fail, most districts faced with a referendum defeat simply return months later for another. Why is there no "sour grapes" outcry from the North-west Herald over this unwillingness to accept defeat?

The reason is clear.

The Northwest Herald never met a tax increase it didn't like, a school district it didn't trust, or a taxpayer advocate it didn't denounce.

Taxpayers know better, and they certainly won't be cursing at Roeser when they get their latest tax bills.

Jim Peschke

Tasteless journalism

To the Editor:

The Northwest Herald's May 19 editorial about electioneering in District 300 truly sets a new low for tasteless journalism. A more appropriate title might have been "Why we love taxes and hate Jack Roeser."

No matter what one thinks of Roeser, the Northwest Herald's assertion that his inquiries are sour grapes is totally baseless. Pass or fail, the District 300 referendum had more than enough "unusual" activity to justify raising questions. When did Roeser ever claim referendums couldn't pass without election interference?

By the Northwest Herald's logic, O.J. Simpson's prosecutors were petty, vindictive types who couldn't accept defeat simply because O.J. was acquitted.

How can a newspaper fail to value a citizen's right to ask questions?

Watergate anyone?

Without fail, most districts faced with a referendum defeat simply return months later for another. Why is there no "sour grapes" outcry from the North-west Herald over this unwillingness to accept defeat?

The reason is clear.

The Northwest Herald never met a tax increase it didn't like, a school district it didn't trust, or a taxpayer advocate it didn't denounce.

Taxpayers know better, and they certainly won't be cursing at Roeser when they get their latest tax bills.

Jim Peschke

Thursday, May 25, 2006

A Former Teacher Tells the Truth - Hat tip Extreme Wisdom

The following letter appears at ExtremeWisdom.com. Be sure to visit Bruno Behrend's website for more letters. For those living in Lake County you can listen to his radio show on WKRS 1220 from 6 - 8 p.m.

Our Union Focused Only on the Teachers

Your May 4 editorial "rotten apples" expressed a belief I've held for almost 50 years; "... unions pretend their political actions are in the interests of "the children" -- except when that conflicts with their own economic self-interest."

Not once in my 35-year teaching career did the Union -- mine was the Michigan Education Association -- negotiate an item not having teacher benefit at its center. It did get me a perpetually better salary, a great medical plan, some extra duty pay for extra work, at least one class period to be devoted to preparation, and some other class-size control attempts. But I, even in retirement, still cannot find a direct correlation between these " negotiated" features and improved teacher classroom performance.

Everything was for me and my fellow teachers. We were all paid the same, a typical Union maneuver, which means no incentive for one to excel, even though some did. And the Union protected members equally regardless of competence. Certification rather qualification determined hiring practices. Most school administrators doing teacher valuations are only competent to assess those teaching in their own former area of classroom teaching. Morals were the only reason any teacher was ever released at my school.

I will eternally remember an admonition from a regional MEA leader to "take coil wires, put sugar in gas tanks, and let air out tires of scabs [teachers who had taken positions of strikers]" during an unusually bitter contract negotiation. Considering all of this along with what you cited in your editorial, it's a real stretch to find the Union rationale that "we care about kids."

Our Union Focused Only on the Teachers

Your May 4 editorial "rotten apples" expressed a belief I've held for almost 50 years; "... unions pretend their political actions are in the interests of "the children" -- except when that conflicts with their own economic self-interest."

Not once in my 35-year teaching career did the Union -- mine was the Michigan Education Association -- negotiate an item not having teacher benefit at its center. It did get me a perpetually better salary, a great medical plan, some extra duty pay for extra work, at least one class period to be devoted to preparation, and some other class-size control attempts. But I, even in retirement, still cannot find a direct correlation between these " negotiated" features and improved teacher classroom performance.

Everything was for me and my fellow teachers. We were all paid the same, a typical Union maneuver, which means no incentive for one to excel, even though some did. And the Union protected members equally regardless of competence. Certification rather qualification determined hiring practices. Most school administrators doing teacher valuations are only competent to assess those teaching in their own former area of classroom teaching. Morals were the only reason any teacher was ever released at my school.

I will eternally remember an admonition from a regional MEA leader to "take coil wires, put sugar in gas tanks, and let air out tires of scabs [teachers who had taken positions of strikers]" during an unusually bitter contract negotiation. Considering all of this along with what you cited in your editorial, it's a real stretch to find the Union rationale that "we care about kids."

Wednesday, May 24, 2006

Do you know the average monthly benefit of TRS recipients?

The average retirement annuity of those receiving monthly TRS benefits as of June 30, 2005 was $3043. The number of recipients is 73,464. Yep that is right the average benifit is $3043 per month for sitting on their behinds doing nothing.

Tuesday, May 23, 2006

Taxing bodies unite to preserve funding aka Doing every thing we can to grab as much money as we can.

Nothing more than money grubbing. The following article appeared in the Illinois School Board Journal.

llinois School Board Journal

May/June 2006

Taxing bodies unite to preserve funding

by Robert Madonia

Robert Madonia is superintendent of schools for Frankfort CCSD 157-C in Will County.

One problem facing school districts, as well as other taxing bodies, is the constant requests by corporate and commercial properties for a reduction in their assessments. Compounding this concern is that these requests are filed after taxes have been collected.

Thus, if approved, these requests carry the potential of large rebates that can deplete fiscal resources. As this occurs, it also starts to shift the burden of taxation from commercial properties to homeowners.

That's why Frankfort School District 157-C has taken the initiative to organize and chair a "taxing body coalition" to help protect property tax revenue at the lowest possible cost. An additional goal is to make certain taxation is fair.

In addition to District 157-C, taxing body members include: the village of Frankfort, Lincoln-Way High School District 210, the Frankfort Fire Department, Frankfort Library, Frankfort Park District and Joliet Junior College.

"It is only through the Frankfort Area Property Tax Appeal Coalition that an institution our size can work for the fair taxation of commercial property within the library district," said Detlev Pansch, administrator at the Frankfort Public Library. "Fair taxation will result in an equitable distribution of support for the library and prevent an undue share from being born by the homeowners."

How does it work?

The process begins when the taxing bodies receive a legal notification of assessment reduction requests of $100,000 or more. The county board of review is the first group to review the commercial owner's request. Typically, the board of review supports the township assessor's valuation of the property.

A representative of the coalition attends all public meetings of the board of review where assessment reduction requests are heard. This puts the public and commercial property owners on notice that the taxing bodies are aware of the assessment reduction requests and of their involvement to make sure that taxation is fair. This simple meeting attendance actually has caused many assessment challenges to be withdrawn.

If the taxing bodies are not going to be involved, sometimes the commercial owners will take a chance to get a refund without a challenge. The fact that some assessment reduction requests are withdrawn at this level makes us believe that, in these cases, the property was not unfairly assessed.

Once the county board of review rules on a case, a commercial property owner can appeal to the state-level Property Tax Appeal Board (PTAB). Again, it is a legal requirement for taxing bodies to receive notice of any appeal to PTAB that is $100,000 or more.

After the taxing body receives this notice, it has 30 days to intervene. The coalition assesses the merits of intervening and will do so when it is financially appropriate. An intervention on a PTAB appeal means the coalition must engage the services of an attorney and secure an independent appraisal of the property in question.

Typically, in our experience, the independent appraisal supports the original township assessor's valuation of the property. Once an independent appraisal has been submitted to the commercial property owner, negotiations usually begin between the coalition and the appealing property owner.

Sometimes a deal can be struck for an assessment somewhere in the middle (below the assessor's level but above the property owner's request) or in some cases it goes all the way to the Property Tax Appeal Board for a decision. If PTAB rules and the property owner is not satisfied, the only other avenue is to appeal PTAB's decision through litigation. In our experience, this rarely occurs.

What has it meant?

As a rapidly growing community, Frankfort has new businesses move in annually. In 2004, we received a PTAB challenge that could have potentially cost District 157-C a $20,000 rebate. In 2005, a department store request potentially could have cost a $30,000 rebate, and the district anticipates a 2006 request from a large national chain of hardware and home supply stores for an assessment reduction that could cost us more than $50,000.

For District 157-C, chairing the coalition has been a proactive measure to preserve fiscal resources, support fair taxation and prevent the burden of taxation from shifting to homeowners. While all taxing bodies must be good stewards of taxpayer dollars, we cannot let our fiscal base erode.

As a coalition, we hope that being proactive instead of reactive will earn the community's respect.

"Since the tax cap and limited tax rates, this coalition of taxing bodies has provided a viable source to fight tax reductions," said Jeff Boubelik, director of the Frankfort Park District. "As part of a fast growing community, the Frankfort Park District relies heavily on the tax dollars we receive to operate and develop new parks, facilities and programming. We only want to collect on the fair assessments of properties in our district. We would be remiss if we did nothing to protect our tax base."

Important facts

If you also are in a growth area, before encouraging you to rush out and create your own taxing body coalition, we would be remiss if we did not share additional important facts about the process.

You must believe in the importance of being proactive rather than reactive and be able to form a working relationship with some ground rules. One of the ground rules is agreeing that the individual taxing bodies in the coalition pay the percentage of all costs at the same percentage level that their tax rate is of the total rate.

This process takes oversight and intervention, and you're never assured of success. The coalition never totally wins these challenges. The goal is just to control our losses.

Property assessments are made by a township assessor. This person is an elected official who is considered the expert in the area of valuing property. Property valuations are based on many factors that are reviewed by the assessor for accuracy. Because of the assessor's expertise, the coalition believes those assessment numbers should be upheld.

The county officials designated to fight these challenges have too many challenges to address and no funds to be effective. Little support is realized at the county level.

In some cases corporate and commercial property owners file automatically every year without any basis to justify that their assessment is accurate. The hope is that they will get money back without experiencing any cost to make the challenge. Some appellants have attorneys on retainer who handle this on an annual basis.

That's why it is so important that taxing bodies intervene in these challenges to preserve their revenue. This process is part of good fiscal stewardship.

Taxing bodies also owe it to their community to prevent the burden of taxation from being shifted from commercial properties to the homeowner.

Top of Page |IASB HOME |2006 Journals |Table of Contents

Monday, May 22, 2006

Property tax bills in Dist. 300 skyrocket

Is reality setting in for those who voted yes and those who did not get to the polls? Will we see improvement in graduation rates and test scores? We doubt it. This folks is why it is so important to vote and get involved. People must no longer be intimidated into voting yes for referenda that will do nothing more than increase spending and fill the pockets of teachers, administrators and those doing business with the schools.

The following article appeared in the Daily Herald. It was also reprinted on the Students First Website.

Property tax bills in Dist. 300 skyrocket

5/22/2006

By Jeffrey Gaunt

Daily Herald

When Linda Mitsch first saw her property tax bill this year, the Carpentersville retiree said she was floored.

"I was shocked," Mitsch said. "Totally shocked. A $1,300 increase."

Across the street, Mitsch said neighbors saw similar spikes in their tax bills - anywhere from $1,300 to $1,900 or more.

"We're on a fixed income," Mitsch said. "We have to save almost $600 a month just to pay for our real estate taxes. That's crazy."

Mitsch wasn't alone. Many area residents saw large spikes in their tax bills this year -from several hundred dollars to more than $3,000 in one year.

And like many perturbed homeowners, Mitsch looked to Community Unit District 300, where voters earlier this year approved two big tax increases.

"Just for the referendum vote alone, for the schools, it went up $700," Mitsch said. "Where is this money going?"

In fact, the District 300 tax increases are only a piece of the puzzle.

For starters, only one of the two voter-approved hikes hit tax bills this year. Homeowners are paying the 55-cent education fund tax-rate increase. But the $185 million bond issue won't hit until next year.

And while it's true the 55-cent tax increase is increasing taxes, there's more at play.

Namely, large increases in property values are driving the large increases in tax bills, independent of the voter-approved tax hikes.

The property tax cap limits the amount of money District 300 can collect from property reassessments - even when voters approve a tax increase.

But the tax cap doesn't protect against shifts in property taxes.

In other words, if your home value increases by 20 percent, and most property values in the district increase by 5 percent, you will pay a larger percentage of any tax increase.

Take Mitsch for example. The value of her home rose almost exactly 20 percent.

It's now worth roughly the same as the home of District 300 school board member John Court.

But Court's home wasn't reassessed this year. The value didn't change.

As a result, Mitsch is paying an extra $1,300 - from about $4,250 to $5,250. Court is only paying an extra $200 - from $5,180 to $5,380. And their homes are the same value.

Court didn't get off the hook because he was a school board member, though.

Superintendent Ken Arndt's tax bill jumped $1,610 - from $6,570 to $8,180. And board member Karen Roeckner's bill went up $3,390 - to a total of $12,760.

"If a particular part of the community hadn't been reassessed in some time, now they are hit big," said Cheryl Crates, District 300 chief financial officer. "It's a good news, bad news thing. The good news is their house is going up in value. The bad news is so are their taxes."

Rather than blaming District 300, property owners should be looking to the county, Dundee Township Assessor Daniel McMahon said.

"We did our job according to state statute," McMahon said of the assessor's office. "Knowing there were some places that we're going to go up 20, 30, 40 percent in value.

"The Kane County Board, they had an opportunity last March to enter into a 7 percent tax cap," McMahon said. "They chose not to do that."

Karen McConnaughay, who heads the county board, said she doesn't remember all of the details of that vote.

But she does remember the county analyzed the numbers, and decided the 7 percent cap wasn't in the best interest of property owners.

"We saw it as a flawed piece of legislation that did not, in fact, accomplish what it was supposed to," McConnaughay said. "We did our own research on the implications of the proposed freeze and came up with the same analysis a lot of other counties came up with.

"It was not a permanent freeze, it was a temporary freeze," she said. "That increase in assessed valuation would be realized, just at a later date."

Even though the board opted not to impose the cap on reassessments, county board member John Noverini said he understands the concerns.

"People are getting fed up," Noverini said. "It's scary. People are being taxed out of their homes."

Noverini said he would support legislation that eliminates all property reassessments until a house is sold.

"That's the way it should be," Noverini said, arguing that houses are the only capital investment where people pay more each year as the value of the asset increases.

"People are upset," Noverini said. "I don't blame them for being upset."

The following article appeared in the Daily Herald. It was also reprinted on the Students First Website.

Property tax bills in Dist. 300 skyrocket

5/22/2006

By Jeffrey Gaunt

Daily Herald

When Linda Mitsch first saw her property tax bill this year, the Carpentersville retiree said she was floored.

"I was shocked," Mitsch said. "Totally shocked. A $1,300 increase."

Across the street, Mitsch said neighbors saw similar spikes in their tax bills - anywhere from $1,300 to $1,900 or more.

"We're on a fixed income," Mitsch said. "We have to save almost $600 a month just to pay for our real estate taxes. That's crazy."

Mitsch wasn't alone. Many area residents saw large spikes in their tax bills this year -from several hundred dollars to more than $3,000 in one year.

And like many perturbed homeowners, Mitsch looked to Community Unit District 300, where voters earlier this year approved two big tax increases.

"Just for the referendum vote alone, for the schools, it went up $700," Mitsch said. "Where is this money going?"

In fact, the District 300 tax increases are only a piece of the puzzle.

For starters, only one of the two voter-approved hikes hit tax bills this year. Homeowners are paying the 55-cent education fund tax-rate increase. But the $185 million bond issue won't hit until next year.

And while it's true the 55-cent tax increase is increasing taxes, there's more at play.

Namely, large increases in property values are driving the large increases in tax bills, independent of the voter-approved tax hikes.

The property tax cap limits the amount of money District 300 can collect from property reassessments - even when voters approve a tax increase.

But the tax cap doesn't protect against shifts in property taxes.

In other words, if your home value increases by 20 percent, and most property values in the district increase by 5 percent, you will pay a larger percentage of any tax increase.

Take Mitsch for example. The value of her home rose almost exactly 20 percent.

It's now worth roughly the same as the home of District 300 school board member John Court.

But Court's home wasn't reassessed this year. The value didn't change.

As a result, Mitsch is paying an extra $1,300 - from about $4,250 to $5,250. Court is only paying an extra $200 - from $5,180 to $5,380. And their homes are the same value.

Court didn't get off the hook because he was a school board member, though.

Superintendent Ken Arndt's tax bill jumped $1,610 - from $6,570 to $8,180. And board member Karen Roeckner's bill went up $3,390 - to a total of $12,760.

"If a particular part of the community hadn't been reassessed in some time, now they are hit big," said Cheryl Crates, District 300 chief financial officer. "It's a good news, bad news thing. The good news is their house is going up in value. The bad news is so are their taxes."

Rather than blaming District 300, property owners should be looking to the county, Dundee Township Assessor Daniel McMahon said.

"We did our job according to state statute," McMahon said of the assessor's office. "Knowing there were some places that we're going to go up 20, 30, 40 percent in value.

"The Kane County Board, they had an opportunity last March to enter into a 7 percent tax cap," McMahon said. "They chose not to do that."

Karen McConnaughay, who heads the county board, said she doesn't remember all of the details of that vote.

But she does remember the county analyzed the numbers, and decided the 7 percent cap wasn't in the best interest of property owners.

"We saw it as a flawed piece of legislation that did not, in fact, accomplish what it was supposed to," McConnaughay said. "We did our own research on the implications of the proposed freeze and came up with the same analysis a lot of other counties came up with.

"It was not a permanent freeze, it was a temporary freeze," she said. "That increase in assessed valuation would be realized, just at a later date."

Even though the board opted not to impose the cap on reassessments, county board member John Noverini said he understands the concerns.

"People are getting fed up," Noverini said. "It's scary. People are being taxed out of their homes."

Noverini said he would support legislation that eliminates all property reassessments until a house is sold.

"That's the way it should be," Noverini said, arguing that houses are the only capital investment where people pay more each year as the value of the asset increases.

"People are upset," Noverini said. "I don't blame them for being upset."

Sunday, May 21, 2006

Has Public Education Been Damaged Beyond Resuscitation?

This excellent piece appeared in the Georgetown Times

Has Public Education Been Damaged Beyond

Resuscitation?

Date: 4/10/2006

Georgetown Times Editorial

By John Brock

In spite of the fact that many honorable folks in the

teaching field have tried their best, I fear that in

bureaucratic attempts to sustain a failing public

education system, we have become more concerned with

“filling the pail” than with the more important task

of “lighting a fire.” Public education in America is

at low ebb.

With layers upon layers of bureaucracy, the prime goal

of which seems sometimes to be justifying a

bureaucrat’s job, we have hamstrung those trying their

hardest to educate our children by taking the

initiative from teachers and placing too much emphasis

on style rather than substance. Our children suffer as

a result.

Remember the old black-and-white television sets with

a host of manual controls? Once you set the

vertical-hold control, it necessitated adjusting the

horizontal hold, which in turn called for the

manipulation of yet another control, until the picture

was thoroughly torn apart and the repairman had to be

called. That’s what we have done to the public

education system. We have “adjusted” it to the point

it is no longer effective as a whole.

This is no less true in South Carolina. ABC’s John

Stossel produced a national segment recently entitled,

“Stupid in America,” pointing to our state as a poster

child for failed public education. Many teachers,

superintendents, and school personnel are doing an

admirable job, but on the whole, the public education

system is not offering quality education to all

students commensurate with the amount of money being

thrown at it. But, whenever someone professes

improvements to American public education, their

solution seems always to be: more money! This is

hogwash. We spend more money per pupil on education

than any other country but our ranking is far below

many smaller, less-developed countries. We have

sufficiently proved to rational minds that more money

is not the solution.

Many citizens fear that public education has reached a

point of no return. The entire procedure needs to be

scraped and a new model started from scratch — based

on ancient principles of learning. Since the

powers-that-be will never agree to a complete

makeover, then our only course of correction appears

to be allowing parents to transfer their children from

failing schools to schools that actually teach. In

many cases this would be private schools, which charge

tuition. We have a responsibility to parents at

under-performing schools to help out with vouchers to

cover the cost for alternative education.

But there is opposition to this approach because

schools will actually have to compete for students.

Competition works elsewhere. But many public educators

vehemently oppose this plan because it means they just

might lose their jobs. Good teachers will always be

able to get work whether in public or private venues.

Suppose we lived in a nation of socialized medicine.

You are assigned to one doctor and one hospital. Never

mind that the doctor is a quack and the hospital has

death rates triple that of other nearby institutions,

you must go to them unless you are wealthy enough to

go to another physician or hospital of your choosing.

Outrageous? You bet. But this is exactly the same

socialized public education situation in which parents

find themselves today, because government dictates

that your child must attend this public school or that

one, regardless of how bad the school might be.

Public school systems today have become huge

bureaucratic caverns where less than 40 per cent of

school personnel actually face students as teachers.

The others are engaged in ancillary functions,

including planning new ways to complicate the

otherwise simple process of teaching.

After careful thought and study, I have concluded that

public education in most parts of America has been

tampered with, adjusted, added to, micro- managed, and

further maligned far beyond our ability to repair it.

Our state is no exception and until we start all over

again or offer an alternative, our children will

continue to be undereducated.

It’s time to re-think the whole process of public

education.

But for South Carolinians, the future is bleak —

especially when the head honcho in the state’s public

school bureaucracy declares in the ABC television

special that South Carolina is seeing great progress

in some areas. “We are ranked No. 1 in the country on

improvement on SAT,” State Superintendent, Inez

Tenenbaum, boasted.

“That’s great” the television show’s host remarked but

added, "when you’re ranked at the bottom, improvement

doesn’t mean much, and South Carolina, even after it

is No. 1 in improvement is still last among states,"

(and then noted) "in government monopolies, that’s how

bureaucrats think.”

The television special concludes that the American

public is pretty much stuck with inferior public

education system unless drastic measures are taken. I

agree.

We must expect more from public education.

An excellent opportunity can be found in offering

parents of school children a choice of which school

their child can attend. What better way to accomplish

this than through vouchers? This will result in

spending no more (perhaps less) money than is now

spent but will restore sanity to public teaching. If

public school systems suffer, so be it! They have had

their chance. It’s time to offer every child the

opportunity of attending an excellent school.

It’s a win/win situation: all parents will have a

choice — regardless of income — public schools will

improve in order to survive and most importantly our

children will be educated!

Competition made America great. Why not give it a

chance to work its wonders in public education?

Mr. Brock lives in Georgetown County. He can be

reached by mail at this newspaper or by e-mail at

brock@johnbrock.com.

Has Public Education Been Damaged Beyond

Resuscitation?

Date: 4/10/2006

Georgetown Times Editorial

By John Brock

In spite of the fact that many honorable folks in the

teaching field have tried their best, I fear that in

bureaucratic attempts to sustain a failing public

education system, we have become more concerned with

“filling the pail” than with the more important task

of “lighting a fire.” Public education in America is

at low ebb.

With layers upon layers of bureaucracy, the prime goal

of which seems sometimes to be justifying a

bureaucrat’s job, we have hamstrung those trying their

hardest to educate our children by taking the

initiative from teachers and placing too much emphasis

on style rather than substance. Our children suffer as

a result.

Remember the old black-and-white television sets with

a host of manual controls? Once you set the

vertical-hold control, it necessitated adjusting the

horizontal hold, which in turn called for the

manipulation of yet another control, until the picture

was thoroughly torn apart and the repairman had to be

called. That’s what we have done to the public

education system. We have “adjusted” it to the point

it is no longer effective as a whole.

This is no less true in South Carolina. ABC’s John

Stossel produced a national segment recently entitled,

“Stupid in America,” pointing to our state as a poster

child for failed public education. Many teachers,

superintendents, and school personnel are doing an

admirable job, but on the whole, the public education