This story below appeared in the Chicago Sun-Times. Hat tip to the folks at The Family Taxpayers Foundation.

Just an FYI. Teachers and administrators can collect their full pensions and work part-time. They can also work full time in other states and collect their pension from Illinois. Every time you vote yes for a referendum you condone this avaricious behavior on the part of your legislators, school employees and government employees.

State lawmakers' pension jackpot

April 6, 2003

BY TIM NOVAK STAFF REPORTER

Advertisement

Art Berman hit the pension jackpot.

The retired state senator's pension is $164,612 a year, almost three times higher than his final salary with the state.

Berman finagled state laws to land a pension that is larger than the pension of any other retired elected official in Illinois, including the past three governors.

His pension is, in fact, $14,000 higher than Gov. Blagojevich's salary.

Berman, who retired in 2001, is among the latest former legislators to jack up their pensions by basing it on a much higher salary from another government job. It's a loophole available only to about 200 current and past legislators elected before 1995, including Blagojevich and Mayor Daley.

But that's just one of several pension sweeteners legislators have given themselves over the years, allowing them to live large in retirement while so many others must scrimp to get by. Most government workers don't get anything close to such generous pensions. Nor do most of the people who must pay for them--the taxpayers.

Berman's pension is based on his $140,416 salary with the Chicago Board of Education, a job he got the day after he left the Senate and held for just 20 months. But rather than collecting a pension based on just 85 percent of that school salary, as provided by state law, Berman got an extra 33 percent boost because he worked in the Legislature longer than necessary to get a top pension. That gave him a $164,612 pension--more than his actual salary.

On top of that, Berman's pension automatically rises 3 percent each year to keep up with inflation.

And, on top of that, he never really retired anyway. Immediately after quitting his schools job--so he could start collecting his big pension--he went right back to work for the schools under an outside consulting contract that pays him $80,000 a year.

"I think that the bottom line is that I worked very, very hard for 31 years in the Legislature,'' said Berman, 67, a Chicago Democrat. "What I receive in pension is what the law provides for me.''

Berman paid $109,292 into the state pension plan in his 31 years in the Senate, but even allowing for the interest earned on that money, he's already recouped it all. From here on out, the state's financially strapped retirement system and tax-payers will finance his retirement.

"These public pensions are much more generous than most people experience,'' said Lawrence Msall, president of the Civic Federation, which monitors government spending. "There needs to be discipline attached to the benefits, such as tying increases to the rate of inflation, rather than an arbitrary level, and setting a maximum level of benefits.''

Generous government pensions--all guaranteed by taxpayers--abound across Chicago, Cook County and Illinois, according to a Chicago Sun-Times analysis of 15 retirement plans with more than 200,000 retirees. If they live long enough, most beneficiaries will receive pensions that exceed their final salaries because of the automatic 3 percent raises every year.

All but two of the 15 retirement plans are set up in such a way that employees can merge their service from various government agencies, such as the city of Chicago, Cook County, the state of Illinois, and any school district. They can move their service into the most generous plan in which they worked so they can collect the highest pension possible. For example, teachers elected to the Legislature can transfer their teacher pension credits into the legislative plan, the most lucrative. All of these government retirement plans let employees begin collecting a pension as early as age 55, sometimes at age 50 with reduced benefits.

While Berman's pension is tops among elected officials, he trails many other government workers, particularly University of Illinois faculty, one of whom has a $305,007 pension, the state's largest. A retired U. of I. athletic coach gets more than $176,000. But, unlike Berman, these government workers don't get pensions that are larger than their final state salaries.

Such generous deals--unheard of in the private sector, where most workers save for retirement through 401(k)s--have left government pension officials wondering whether they can make ends meet. The huge payouts strain many retirement funds that are woefully undercapitalized. Their investments, particularly in stocks, have plunged in value and many governments--especially the state--have failed to contribute their share of pension costs.

Among the 15 funds, the legislators retirement fund is the worst funded, with just 29 percent of the money needed to pay these pensions. And, adding to the problem, it's difficult for pension fund managers to know how much money the fund should have because legislators constantly find ways to jack up their pensions, just before they retire, far above their salaries.

"Government is the last bastion of rich pensions,'' said Mike Johnston, a pension expert for Hewitt Associates, a human resource consultant in north suburban Lincolnshire. "Private companies have reviewed their pension plans. They've cut their pension plans. They've put in 401(k)s. But government has done nothing.''

Government workers justify their higher pensions by pointing out that, for the most part, they are barred from participating in the Social Security system.

Dozens of government workers have significantly boosted their incomes by collecting a pension from one agency while working for another. Among them are former Chicago Police Supt. LeRoy Martin, Cook County Judge Nancy Drew Sheehan, state Sen. Lou Viverito and Secretary of State Jesse White. The Sun-Times will report that part of the story in Monday's paper.

And hundreds of retirees get at least two government pensions. These include former Cook County Judge John Beatty, former Cook County Board President George Dunne, former state Sen. Beverly Fawell and former state Rep. William Laurino.

*****

Legislators aren't the only public officials taking advantage of lucrative pension loopholes. Like Berman, several DuPage and Will county elected officials are receiving pensions based on their last day's pay. That loophole is open to scores of elected county officials who held office between 1994 and 2001.

Berman said he was surprised to hear his pension is tops for all legislators. But he doesn't think his former constituents will object. "I think they'll be surprised," he said. "But would they turn the clock back 31 years and not have Art Berman serve at all? I don't think so.''

Almost half of the 249 retired lawmakers now collecting pensions receive checks that exceed their final salary as a legislator, state records show. Illinois legislators, who set all government pension laws in the state, have given themselves the best benefits.

Legislators with 20 years of government service can get a pension equal to 85 percent of their final day's pay, which can come from virtually any job in a city, county or state agency. After several used the loophole to strike it rich, the Legislature closed the loophole for those elected after 1995.

Under another loophole that one lawmaker wants to plug, legislators who serve more than 20 years--the total needed for a top pension--get a 3 percent boost in their pension for each extra year of service. The only catch is that they must be retired for a year to get that bump. Thanks to that rule, former Gov. George Ryan's pension will soar 39 percent next year.

Berman used both loopholes.

When Berman left the state Senate on Jan. 2, 2000, his salary was $59,657. That entitled him to a pension of $50,708, which would have jumped to $67,442 a year later because he had 11 extra years of service. But he rejected that option.

Instead, Berman went to work the very next day as the Chicago Board of Education's director of labor mediation services, hired by an old friend, Chicago Public Schools Supt. Paul Vallas. Berman retired from that post on Aug. 31, 2001, at which point his state pension could now be based on his $140,516 salary from the schools.

That gave Berman an initial pension of $119,440, which soared to $164,612 last year when his extra years of service in the Legislature were taken into account.

But all the while, Berman never stopped working as the school's director of labor mediation services. He went from a regular employee earning $140,516 to a contractual worker earning $80,000 annually.

"I have to keep 26 labor unions happy and the Board of Education happy,'' Berman said. "That's only part of my

responsibilities here. I sit in on legislative agenda meetings. I serve on three statewide commissions dealing with education policy and funding, and I'm constantly in touch with my fellow legislators and policymakers. "I fight for education and children,'' he said.

"I would have made a lot more money by not going to work for the Board of Education, going back to my law firm, and just drawing my pension based on my legislative salary.''

Saturday, June 03, 2006

Friday, June 02, 2006

Two pensions and a county job at 91

This story below appeared in the Chicago Sun-Times. Hat tip to the folks at The Family Taxpayers Foundation.

Just an FYI. Teachers and administrators can collect their full pensions and work part-time. They can also work full time in other states and collect their pension from Illinois. Every time you vote yes for a referendum you condone this avaricious behavior on the part of your legislators, school employees and government employees.

Two pensions and a county job at 91

BY TIM NOVAK STAFF REPORTER

Erwin "Red'' Weiner may be the oldest double dipper in Illinois.

At 91, Weiner has two government pensions and a job with the Cook County Forest Preserve District, which would give him an annual income of $188,873.

But Weiner has been on disability leave for the past 18 months so he's only been getting half of his $73,263 salary along with pension checks worth $115,610. His disability payments run out in May.

Weiner could not be reached for comment. He is a close friend of Cook County Board President John Stroger, who runs the forest preserve district.

Weiner is a maintenance superintendent for the forest preserve. He gets an $84,233 pension as a retired county employee, and a $31,377 pension from the Chicago Park District.

After 40 years at the parks, Weiner retired in 1969 as general superintendent, the top job. He began collecting a pension in 1970 when he landed a county job. He was the county's human resources chief when he retired again in 1993. He started at the forest preserve in January 1995.

Just an FYI. Teachers and administrators can collect their full pensions and work part-time. They can also work full time in other states and collect their pension from Illinois. Every time you vote yes for a referendum you condone this avaricious behavior on the part of your legislators, school employees and government employees.

Two pensions and a county job at 91

BY TIM NOVAK STAFF REPORTER

Erwin "Red'' Weiner may be the oldest double dipper in Illinois.

At 91, Weiner has two government pensions and a job with the Cook County Forest Preserve District, which would give him an annual income of $188,873.

But Weiner has been on disability leave for the past 18 months so he's only been getting half of his $73,263 salary along with pension checks worth $115,610. His disability payments run out in May.

Weiner could not be reached for comment. He is a close friend of Cook County Board President John Stroger, who runs the forest preserve district.

Weiner is a maintenance superintendent for the forest preserve. He gets an $84,233 pension as a retired county employee, and a $31,377 pension from the Chicago Park District.

After 40 years at the parks, Weiner retired in 1969 as general superintendent, the top job. He began collecting a pension in 1970 when he landed a county job. He was the county's human resources chief when he retired again in 1993. He started at the forest preserve in January 1995.

Thursday, June 01, 2006

John Dewey’s Theories of Education on Marxists Archive - Notable AFT Figure.

By W. F. Warde (George Novack)

John Dewey’s Theories of Education

Written: 1960

Source: International Socialist Review, Vol. 21, No. 1, Winter 1960.

Transcription/Editing: 2005 by Daniel Gaido

HTML Markup: 2005 by David Walters

Public Domain:George Novak Internet Archive 2005; This work is completely free. In any reproduction, we ask that you cite this Internet address and the publishing information above.

October 20, 1959 marked the one-hundredth anniversary of John Dewey’s birthday. This eminent thinker of the Progressive movement was the dominant figure in American education. His most valuable and enduring contribution to our culture came from the ideas and methods he fathered in this field.

Dewey won a greater international following for his educational reforms than for his instrumentalist philosophy. Between the two World Wars, where previously backward countries were obliged to catch up quickly with the most modern methods, as in Turkey, Japan, China, the Soviet Union and Latin America, the reshapers of the educational system turned toward Dewey’s innovations for guidance.

Most broadly considered, Dewey’s work consummated the trends in education below the university level initiated by pioneer pedagogues animated by the impulses of the bourgeois-democratic revolution. This was especially clear in his views on child education which built on ideas first brought forward by Rousseau, Pestalozzi and Froebel in Western Europe and by kindred reformers in the United States.

In its course of development on a world scale the democratic movement forced consideration of the needs and claims of one section of the oppressed after another. Out of the general cause of “rights of the people” there sprouted specific demands voicing the grievances of peasants, wage workers, the religiously persecuted, slaves, women, paupers, the aged, the disabled, prisoners, the insane, the racially oppressed.

The movement to reform child education must be viewed in this historical context. Children as such are not usually included among the oppressed. Yet they necessarily compose one of the weakest, most dependent and defenseless sections of the population. Each generation of children is not only helped but hindered and hurt by the elders who exercise direct control over them.

To view the rest of the story go to Marxists Internet Archive.

The American Federation of Teachers has always counted John Dewey as one of its notable figures.

John Dewey’s Theories of Education

Written: 1960

Source: International Socialist Review, Vol. 21, No. 1, Winter 1960.

Transcription/Editing: 2005 by Daniel Gaido

HTML Markup: 2005 by David Walters

Public Domain:George Novak Internet Archive 2005; This work is completely free. In any reproduction, we ask that you cite this Internet address and the publishing information above.

October 20, 1959 marked the one-hundredth anniversary of John Dewey’s birthday. This eminent thinker of the Progressive movement was the dominant figure in American education. His most valuable and enduring contribution to our culture came from the ideas and methods he fathered in this field.

Dewey won a greater international following for his educational reforms than for his instrumentalist philosophy. Between the two World Wars, where previously backward countries were obliged to catch up quickly with the most modern methods, as in Turkey, Japan, China, the Soviet Union and Latin America, the reshapers of the educational system turned toward Dewey’s innovations for guidance.

Most broadly considered, Dewey’s work consummated the trends in education below the university level initiated by pioneer pedagogues animated by the impulses of the bourgeois-democratic revolution. This was especially clear in his views on child education which built on ideas first brought forward by Rousseau, Pestalozzi and Froebel in Western Europe and by kindred reformers in the United States.

In its course of development on a world scale the democratic movement forced consideration of the needs and claims of one section of the oppressed after another. Out of the general cause of “rights of the people” there sprouted specific demands voicing the grievances of peasants, wage workers, the religiously persecuted, slaves, women, paupers, the aged, the disabled, prisoners, the insane, the racially oppressed.

The movement to reform child education must be viewed in this historical context. Children as such are not usually included among the oppressed. Yet they necessarily compose one of the weakest, most dependent and defenseless sections of the population. Each generation of children is not only helped but hindered and hurt by the elders who exercise direct control over them.

To view the rest of the story go to Marxists Internet Archive.

The American Federation of Teachers has always counted John Dewey as one of its notable figures.

Wednesday, May 31, 2006

SAT scores dropped significantly this year. Blame the schools, not the test.

The following piece appeared in the Wall Street Journal.

How Low Can We Go?

SAT scores dropped significantly this year. Blame the schools, not the test.

BY DAVID S. KAHN

Friday, May 26, 2006 12:01 a.m. EDT

Colleges across the country are reporting a drop in SAT scores this year. I've been tutoring students in New York City for the SAT since 1989, and I have watched the numbers rise and fall. This year, though, the scores of my best students dropped about 50 points total in the math and verbal portions of the test (each on a scale of 200 to 800). Colleges and parents are wondering: Is there something wrong with the new test? Or are our children not being taught what they should know?

Before 1994, the verbal section of the SAT was about 65% vocabulary (55 out of 85 questions) and 35% reading comprehension. Then the Educational Testing Service shortened and reworked the test, devoting half of the 78 questions to each area. Last year ETS changed the test again, and now it is heavily skewed toward reading: 49 of the 68 items require students to read, synthesize and answer questions.

In such a way, ETS has increased the penalty for not reading throughout one's school years. Studying vocabulary lists before the test--a long-favored shortcut to lifting scores--just won't cut it anymore. Students who read widely and often throughout their elementary and high-school years develop the kinds of reading skills measured by the new SAT. Students who avoid reading don't--and can't develop them in a cram course.

The math section of the test also got more challenging. The SAT used to test algebra, geometry and arithmetic. Students weren't allowed to use calculators on the original SAT, so some of those problems were simply difficult arithmetical calculations (fractions, decimals and percentages). In 1994, calculators were allowed, and the questions got a bit easier--and I watched my students' math scores jump. But last year ETS made it harder by adding pre-calculus questions, and my students have struggled.

Now there are also fewer math questions--each of which counts for more. The 54 math questions count for 11 points each now (on the 200 to 800 scale); before, there were 60 questions that counted for 10 each. So if a student gets 20 questions wrong, he effectively loses 222 points instead of the former 200.

Quite simply, this is not the same SAT. Students, anxious parents and college admissions officers can't really equate this new test with those of previous years--or their results. We need to adjust our expectations accordingly. It used to be that a 650 was a really high score. After a batch of adjustments, 700 became a really high score. Now it's probably around 670. Or to use the new SAT scale--a scale that includes a writing sample graded for another possible 800 points--you've done pretty well if you eke out a score of 2000, out of a possible 2400.

Some colleges attribute the drop in numbers to the fact that the test is longer--the writing sample has added about an hour to the test's time. If so, then students should do worse on the last sections of the test than they do on the earlier parts. (There are 10 sections to the new SAT.) That hasn't been the case for my (admittedly small) sample of students.

The colleges also think that the lowering of average test scores may have something to do with the cost of taking the test. It is now $41.50, up from $28 in 2004, and so they suggest that fewer students are taking the test twice (which generally results in a slightly higher score). But that theory is weak. Colleges also report that potential students are sending them more applications than ever before, from an average of five per student to 10 or more. Given that college applications usually cost between $50 and $75 per school, the colleges are saying that students are paying an extra $250 and more to apply to additional colleges but won't pay to take the SAT a second time because the price of the test has gone up $13. I'm skeptical.

The explanation is much more straightforward. The average American receives a pretty mediocre education. The average SAT score drifted down from 1000 in the 1960s to 880 in 1993. Education activists attributed this plummet to cultural factors, a change in the testing pool and other matters. The blame was placed everywhere but on schools. That the quality of education in America declined from the 1960s to the 1990s was hardly noted in debates over the SAT.

And then the test was "recentered." Thanks to the change in the SAT scale and the change in the kinds of questions that were asked on the test, scores went up and people were able to ignore the fact that most students are not well-educated. Indeed, parents compared their children's scores with their own and concluded that their children were brilliant. Now ETS has made it a little harder to get away with not knowing your three R's.

People complain that the SAT is biased and that the bias explains why students don't do well. That's true--it is biased. It's biased against people who aren't well-educated. The test isn't causing people to have bad educations, it's merely reflecting the reality. And if you don't like your reflection, that doesn't mean that you should smash the mirror.

That the new SAT tests more reading comprehension than the old test did is a good thing. Colleges complain that their incoming students don't have sufficient skills to read and analyze the kind of material that their professors will assign them. I hope that the new SAT's emphasis will make students realize that you can't get much of an education if you can't read.

Maybe the decline in SAT scores will force people to notice that their children are not getting good educations. If your children don't read or do math, why would you think that they would do well on the SAT? I would love to get into a time machine and go back to 1960 and give this new SAT to high-school students back then. I suspect that they would do much better than today's students. If we want people to get good scores on the SAT, I have a suggestion. Stop complaining about how unfair the test is and do your homework.

How Low Can We Go?

SAT scores dropped significantly this year. Blame the schools, not the test.

BY DAVID S. KAHN

Friday, May 26, 2006 12:01 a.m. EDT

Colleges across the country are reporting a drop in SAT scores this year. I've been tutoring students in New York City for the SAT since 1989, and I have watched the numbers rise and fall. This year, though, the scores of my best students dropped about 50 points total in the math and verbal portions of the test (each on a scale of 200 to 800). Colleges and parents are wondering: Is there something wrong with the new test? Or are our children not being taught what they should know?

Before 1994, the verbal section of the SAT was about 65% vocabulary (55 out of 85 questions) and 35% reading comprehension. Then the Educational Testing Service shortened and reworked the test, devoting half of the 78 questions to each area. Last year ETS changed the test again, and now it is heavily skewed toward reading: 49 of the 68 items require students to read, synthesize and answer questions.

In such a way, ETS has increased the penalty for not reading throughout one's school years. Studying vocabulary lists before the test--a long-favored shortcut to lifting scores--just won't cut it anymore. Students who read widely and often throughout their elementary and high-school years develop the kinds of reading skills measured by the new SAT. Students who avoid reading don't--and can't develop them in a cram course.

The math section of the test also got more challenging. The SAT used to test algebra, geometry and arithmetic. Students weren't allowed to use calculators on the original SAT, so some of those problems were simply difficult arithmetical calculations (fractions, decimals and percentages). In 1994, calculators were allowed, and the questions got a bit easier--and I watched my students' math scores jump. But last year ETS made it harder by adding pre-calculus questions, and my students have struggled.

Now there are also fewer math questions--each of which counts for more. The 54 math questions count for 11 points each now (on the 200 to 800 scale); before, there were 60 questions that counted for 10 each. So if a student gets 20 questions wrong, he effectively loses 222 points instead of the former 200.

Quite simply, this is not the same SAT. Students, anxious parents and college admissions officers can't really equate this new test with those of previous years--or their results. We need to adjust our expectations accordingly. It used to be that a 650 was a really high score. After a batch of adjustments, 700 became a really high score. Now it's probably around 670. Or to use the new SAT scale--a scale that includes a writing sample graded for another possible 800 points--you've done pretty well if you eke out a score of 2000, out of a possible 2400.

Some colleges attribute the drop in numbers to the fact that the test is longer--the writing sample has added about an hour to the test's time. If so, then students should do worse on the last sections of the test than they do on the earlier parts. (There are 10 sections to the new SAT.) That hasn't been the case for my (admittedly small) sample of students.

The colleges also think that the lowering of average test scores may have something to do with the cost of taking the test. It is now $41.50, up from $28 in 2004, and so they suggest that fewer students are taking the test twice (which generally results in a slightly higher score). But that theory is weak. Colleges also report that potential students are sending them more applications than ever before, from an average of five per student to 10 or more. Given that college applications usually cost between $50 and $75 per school, the colleges are saying that students are paying an extra $250 and more to apply to additional colleges but won't pay to take the SAT a second time because the price of the test has gone up $13. I'm skeptical.

The explanation is much more straightforward. The average American receives a pretty mediocre education. The average SAT score drifted down from 1000 in the 1960s to 880 in 1993. Education activists attributed this plummet to cultural factors, a change in the testing pool and other matters. The blame was placed everywhere but on schools. That the quality of education in America declined from the 1960s to the 1990s was hardly noted in debates over the SAT.

And then the test was "recentered." Thanks to the change in the SAT scale and the change in the kinds of questions that were asked on the test, scores went up and people were able to ignore the fact that most students are not well-educated. Indeed, parents compared their children's scores with their own and concluded that their children were brilliant. Now ETS has made it a little harder to get away with not knowing your three R's.

People complain that the SAT is biased and that the bias explains why students don't do well. That's true--it is biased. It's biased against people who aren't well-educated. The test isn't causing people to have bad educations, it's merely reflecting the reality. And if you don't like your reflection, that doesn't mean that you should smash the mirror.

That the new SAT tests more reading comprehension than the old test did is a good thing. Colleges complain that their incoming students don't have sufficient skills to read and analyze the kind of material that their professors will assign them. I hope that the new SAT's emphasis will make students realize that you can't get much of an education if you can't read.

Maybe the decline in SAT scores will force people to notice that their children are not getting good educations. If your children don't read or do math, why would you think that they would do well on the SAT? I would love to get into a time machine and go back to 1960 and give this new SAT to high-school students back then. I suspect that they would do much better than today's students. If we want people to get good scores on the SAT, I have a suggestion. Stop complaining about how unfair the test is and do your homework.

Tuesday, May 30, 2006

Taxpayer advocacy group plans to file suit.

More Questions Arise as Suit is Being Finalized!

(Updated 05/20/06)

While compiling the list of documentation supporting our claims of questionable practices surrounding our new schools, additional facts were discovered that raise even more questions about the validity of this project. Some of the questions we hope to get answers to during the course of litigation are as follows.

1. Did the state approve enough repairs to allow our district to legally sell bonds?

2. If the contracts specified same size buildings, why are the new buildings 30-40% larger?

3. Why would the regional superintendent give these buildings passing grades on annual inspections, then sign off on destroying them based on unsupported claims of serious safety concerns?

To view the rest of the story visit the Coalition For Public Awareness website.

We have often said investigate and you will find waste, corruption, patronage and/or fraud. That is exactly what the Coalition For Public Awareness

is uncovering. This site serves as an example for others to follow.

Public schools are nothing more than government run schools. Like in the government you will find waste, fraud, corruption and patronage. The governor and legislators of Illinois our essentially beholden to the lobbyist of the public education system. This can be seen almost daily in the newspapers and the legislation that is granted in favor of the employees of these systems.

(Updated 05/20/06)

While compiling the list of documentation supporting our claims of questionable practices surrounding our new schools, additional facts were discovered that raise even more questions about the validity of this project. Some of the questions we hope to get answers to during the course of litigation are as follows.

1. Did the state approve enough repairs to allow our district to legally sell bonds?

2. If the contracts specified same size buildings, why are the new buildings 30-40% larger?

3. Why would the regional superintendent give these buildings passing grades on annual inspections, then sign off on destroying them based on unsupported claims of serious safety concerns?

To view the rest of the story visit the Coalition For Public Awareness website.

We have often said investigate and you will find waste, corruption, patronage and/or fraud. That is exactly what the Coalition For Public Awareness

is uncovering. This site serves as an example for others to follow.

Public schools are nothing more than government run schools. Like in the government you will find waste, fraud, corruption and patronage. The governor and legislators of Illinois our essentially beholden to the lobbyist of the public education system. This can be seen almost daily in the newspapers and the legislation that is granted in favor of the employees of these systems.

Monday, May 29, 2006

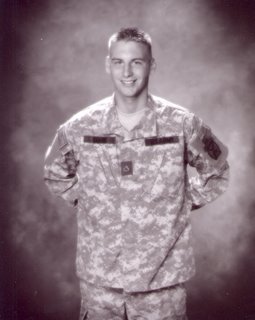

U.S. Army Spc, E-4, Eric D. Clark

Dear Friends and Readers,

We were out of town and also dealing with the loss of a good friend's son in the Iraq conflict. Memorial Day is May 29th. Please take a moment to say a prayer or if you do not pray take a moment to remember all those who have fought and died for our freedom.

We updated our Blog with posts for the following dates May 12th through May 25th.

We realize this is not an ordinary post however it is because of men like Eric D. Clark that we are a free country. Bravery of our soldiers allows us to fight for education reform and education spending reform.

United States Army Specialist E-4, Eric D. Clark, age 22, of Pleasant Prairie was killed while on active duty, serving his country at Camp Liberty, Baghdad, Iraq.

Born in Winfield, IL on July 14, 1983 and destined for great things, Eric was the first born to proud parents, Joanne Leipzig and Kevin Clark.

He attended St. Therese Elementary School, St. Joseph Jr. High School and was a 2001 graduate of Indian Trails Academy where his interest in multimedia expanded. While attending High School, Eric enjoyed working for Tinseltown, and enlisted in the U.S. Army while employed at Pizza Hut. His enlistment was a personal goal because Eric wanted to serve his country. He enrolled in an accelerated program, allowing him to achieve a higher military rank when he began his service career.

His faith was enhanced as a member of St. Anthony Catholic Church - his talent as a musician flourished as a member of the CYO Band where he played the flute and drums. But Eric’s life was really more about what he did for others that made such an impact. Considered an “Impressionist”, Eric could flawlessly assume the voice and character of actors as well as social and cultural dialects. He had a true passion for acting and aspired to one day influence the lives of children through a career as a teacher.

Aside from the selfless act of serving our country in the U.S. Army, Eric was an incredible person. He had the natural ability to lighten the mood, put a smile on your face, and add positive energy to any room. Wherever he went and whatever he did seemed to make a lasting impression on the lives of those he came in contact with. Young and old alike took to this young man full of life – touching people’s hearts and minds at every turn.

Eric’s military career spanned only a few short years, but included: Boot Camp at Fort Sill, Oklahoma, graduating in May 2003. He was then deployed to Korea, at Camp Hovey – 2-17th Artillery “Steel Battalion” Alpha Battery serving from June 2003 to July 2004. Eric achieved placement in 10th Mountain Division, Fort Drum, New York in July 2004, then was deployed to Iraq in August 2005.

He will always be remembered for unselfishly protecting the freedoms of his country, and remarkably influencing the lives of his family and friends.

Eric leaves to cherish his memory his mother and step-father, Joanne and Bob Marfechuk, of Pleasant Prairie; his father and step-mother, Kevin and Paula Clark, of Kenyon, MN; a sister, Jade Clark, a student at Northern Arizona Univ., Flagstaff, AZ; a brother Evan Clark at home; twin half-sisters Meg and Audra Clark; Maternal Grandmother, Mary Leipzig, of Kenosha; Paternal Grandparents, Dan and Yvonne Clark, of Pardeeville, WI; Maternal Step-Grandparents, Walter and Josephine Marfechuk, of Warren, MI; a step-brother Jared Buckingham; and a step-sister, Anna Buckingham.

He was preceded in death by his Maternal Grandfather, Harry Leipzig; and a brother, Eric Joseph, in infancy.

Sunday, May 28, 2006

Everyone Has Been Conned!

"Everyone has been conned - you can give public schools all the money in America and it will never be enough." Ben Chavis a former public school prinicipal now runs a Charter School.

The above quote was found in John Stossel's Myths, Lies, and Downright Stupidity Get Out the Shovel Why Everything YOu Know Is Wrong.

The above quote was found in John Stossel's Myths, Lies, and Downright Stupidity Get Out the Shovel Why Everything YOu Know Is Wrong.

Subscribe to:

Comments (Atom)